Last week saw the release of several important economic indicators globally. In the United States, inflation showed signs of easing, with the headline Consumer Price Index (CPI) slowing to 2.4% year-on-year, while core inflation held steady at 2.8%, indicating a gradual cooling in inflationary pressures. This came alongside a slight uptick in jobless claims and improved consumer sentiment. In the Eurozone, GDP and industrial production contracted, reflecting continued economic weakness. In the UK, wage growth slowed while the unemployment rate rose to 4.6%. Japan’s economy remained stagnant with zero GDP growth for the quarter and a drop in industrial output. In China, foreign trade data showed a marked slowdown in export growth and a deeper contraction in imports, while both consumer and producer price indices continued to decline—underscoring deflationary pressures and weak domestic and global demand.

Market Analysis

EUR/USD

The euro hit 1.1632 against the US dollar on Thursday, June 12, 2025 — its highest level since October 29, 2021 — before closing at 1.1550 on Friday. The decline was primarily due to the US dollar’s safe-haven appeal amid the ongoing conflict between Israel and Iran. Year-to-date, the pair is up approximately 12%. The Relative Strength Index (RSI) currently reads 63, indicating bullish momentum for the EUR/USD pair.

Ethereum

Ethereum, the world’s second-largest cryptocurrency by market cap after Bitcoin, reached $2,880 on Wednesday, June 11, 2025 — its highest level since February 24, 2025 — and is currently trading above $2,500. Prices have surged by roughly 108% since the April 9 low of $1,383, although they remain down about 24% year-to-date. The RSI stands at 50, indicating neutral momentum.

Crude Oil

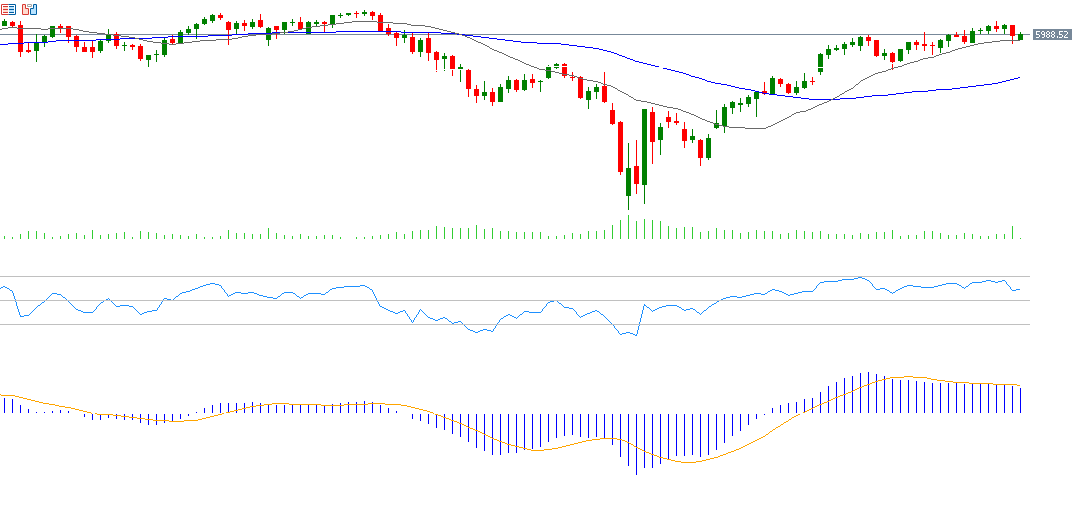

Crude oil prices have risen by around 34% from the low of $58.75 on Monday, May 5, 2025, to a peak of $78.45 on Friday, June 13, 2025. Prices are currently hovering near $75.00 amid market uncertainty driven by various conflicting factors. The primary driver of the recent rally has been the Israel-Iran conflict and fears of broader regional escalation. Despite the recent gains, oil prices are still down about 1% year-to-date. The RSI currently reads 73, indicating strong bullish momentum. Additionally, the MACD indicator shows a bullish crossover, with the MACD line (blue) crossing above the signal line (orange), reinforcing the positive outlook.

S&P 500

The S&P 500 declined by 0.39% last week, despite hitting 6,059 on Wednesday, June 11, 2025 — its highest level since February 21, 2025. The index closed Friday below the 6,000 mark at 5,977. The decline was driven by negative investor sentiment amid the ongoing Israel-Iran war and fears of broader conflict. The RSI currently stands at 59, reflecting a moderately bullish momentum for the index.

Key Events This Week

Markets will closely monitor the following key economic events this week:

- Monday: China’s retail sales, industrial production, fixed-asset investment, and unemployment rate; Switzerland’s Producer Price Index; Eurozone average wages; and the New York Empire State Manufacturing Index.

- Tuesday: Bank of Japan interest rate decision (expected to remain at 0.50%); US retail sales and industrial production data.

- Wednesday: US Federal Reserve interest rate decision (expected to hold at 4.25%-4.50%); markets will focus on Fed Chair Jerome Powell’s speech for forward guidance. The Fed’s dot plot will also be released, along with inflation, unemployment, and interest rate projections. Additionally, Japan’s export/import data, Eurozone and UK CPI, and US crude oil inventories will be published.

- Thursday: Swiss National Bank interest rate decision; Bank of England rate decision (expected to hold at 4.25%); Australian employment and unemployment data; and US jobless claims.

- Friday: People’s Bank of China loan prime rate decision; Japan CPI; UK retail sales; US Philadelphia Fed Manufacturing Index; and Canadian retail sales and Producer Price Index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.