Last week featured several important economic indicators around the world. In the United States, inflation data was mixed, with the headline Consumer Price Index rising to 2.7% while the Producer Price Index fell to 2.3%. Retail sales and industrial indicators showed notable improvement. In the Eurozone, industrial production rose by 1.7%, while inflation remained stable at 2.0%. In the UK, inflation increased to 3.6% alongside a rise in unemployment to 4.7%. In Japan, exports and industrial production declined, imports rose, and CPI growth slowed. In China, data showed strong growth in industrial production at 6.8%, but retail sales and investment growth slowed. The Chinese economy recorded 5.2% GDP growth in the second quarter. In Canada and Australia, indicators pointed to a slowdown in inflation and employment, while Switzerland recorded a slight contraction in producer prices.

Market Analysis

USD/JPY Pair

The USD/JPY pair continues its upward trend, reaching 149.19 on Wednesday, July 16, the highest level since April 3, 2025. It is currently trading near 149.00. The pair has risen by 5% from the low of 142.68 recorded on July 1, 2025, to the recent peak, but is still down around 6% year-to-date. Pressures on the yen include anticipation of the upcoming Japanese parliamentary elections, with expectations of losses for the ruling Liberal Democratic Party and gains for opposition parties promising tax cuts and increased public spending. A major concern is Japan’s high public debt, estimated at about 250% of GDP, which raises fears of worsening debt levels in the future. Also contributing to yen weakness are rising Japanese government bond yields, especially long-term bonds, and weak recent economic data.

The Relative Strength Index (RSI) is currently at 65, indicating bullish momentum for the pair. The MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), reinforcing positive momentum.

Tesla

Tesla’s stock has dropped by approximately 18% year-to-date. Markets are awaiting Tesla’s financial results on Wednesday, July 23, 2025. Earnings are expected to be $0.48 per share, down from $0.52 previously. Revenue is expected to reach $93.70 billion, up from $84.74 billion. The RSI is currently at 56, reflecting positive momentum. The MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), adding to the stock’s upward momentum.

Gold

Since hitting an all-time high of $3,500 on April 22, 2025, gold has been trading sideways between strong support at $3,200 and resistance at $3,400, searching for a clear direction. Despite the fluctuations, gold is still up around 27% year-to-date.

Gold is facing some pressure due to the strengthening US dollar and easing trade tensions. However, continued central bank buying provides support. The RSI is currently at 53, indicating mild bullish momentum. The MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), reinforcing positive expectations.

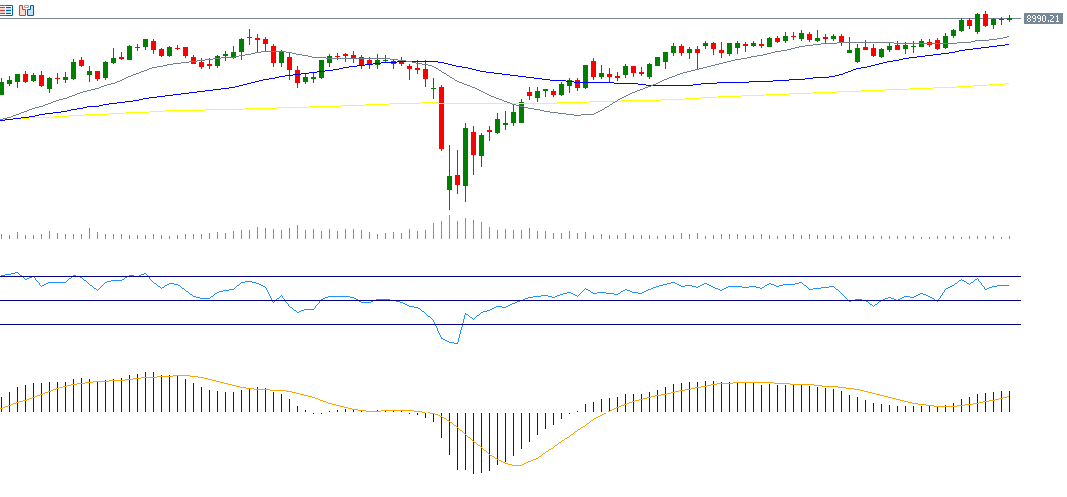

FTSE 100 Index

The UK’s FTSE 100 index reached an all-time high of 9,042 points on Tuesday, July 15. The index has risen about 20% from the April 7 low of 7,533 points to its current peak. It is up around 10% year-to-date, outperforming US indices like the S&P 500 and Nasdaq 100, but still lagging behind Germany’s DAX, which is up 22%.

The sharp rise in the FTSE 100 is attributed to a trade agreement between the UK and the US, strong bilateral relations, expectations of continued accommodative monetary policy or rate cuts by the Bank of England, and a weak British pound versus the US dollar. The RSI is currently at 57, reflecting bullish momentum. The MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), supporting the upward trend.

Key Events This Week

- Monday: China’s prime lending rate

• Tuesday: Speech by US Federal Reserve Chair Jerome Powell

• Wednesday: US existing home sales and crude oil inventories

• Thursday: European Central Bank interest rate decision (expected to remain unchanged), manufacturing and services PMIs in Australia, Japan, Eurozone, UK, and US, as well as US new home sales and jobless claims

• Friday: Tokyo CPI, UK retail sales, and US durable goods orders

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.